How to Ensure You’re Building a Sustainable Company

Here’s a follow-up to our recent overview of the multi-capital model that highlights how this model can be applied to help drive sustainability in your organization.

The multi-capital model is a classification tool that helps companies identify the full set of relationships with and resources from shareholders, stakeholders and the environment. This way of thinking provides a systems view that helps leaders see, understand and balance the value/cost/risk tradeoffs their decisions have on net corporate value. It’s also the kind of thinking behind the Triple Bottom line and ESG approaches.

The simplest way to think about the sustainability of your capitals is to evaluate whether you are:

Creating Value – Of course, the goal of all teams is to build and grow for the future. This means your team is creating excess value that can be used to accelerate growth and fulfill your company’s purpose.

Preserving Value – This is the baseline for companies. You want to, at a minimum, continue to have access to the resources you need to operate today, tomorrow and in the coming years. In fact, author Sean Lyons makes a compelling case that value preservation is the fundamental duty of a company’s board and senior management.

Eroding Value – We all know that value erosion creates risk for companies. Yet it’s common for people to make decisions that focus on only one capital at the expense of others.

Destroying Value – When value erosion is left unattended, it can devolve into value destruction. Decisions made without careful consideration of multi-capital impact have a much higher risk of destroying value for one or more of the capitals.

For example, a common decision made by management teams is to cut staff. This decision will may increase financial capital in the short run. But it is also likely to erode or destroy the value of employee capital (manifest as low morale), structural/intellectual capital (manifest as loss of employee knowledge), customer capital (manifest as poor customer service) and, depending on the work that’s eliminated, may also erode environmental capital. The decision may still have to be made. But a multi-capital analysis gives voice to issues that should be considered and addressed to limit collateral damage.

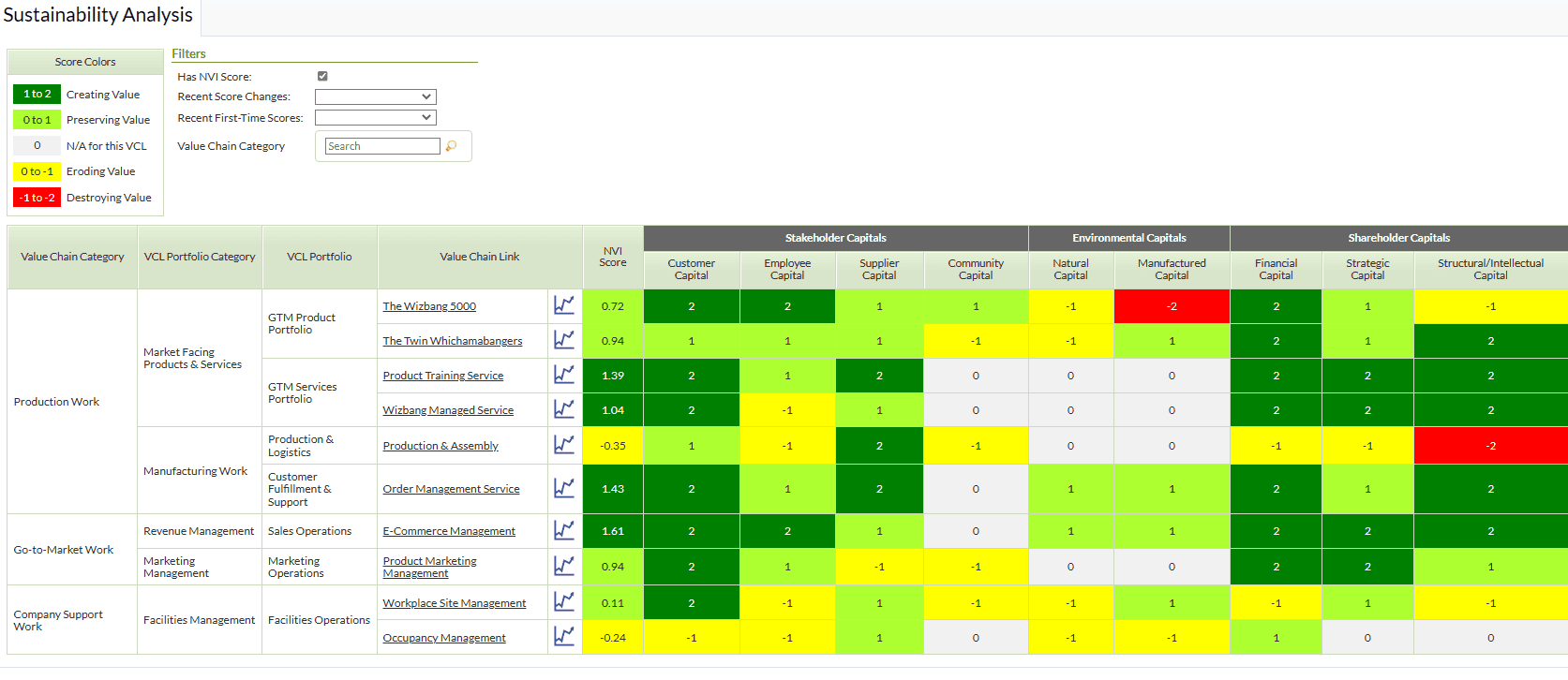

So how can you ensure that all the capitals are considered in management decisions? Equip your teams with a systemic, multi-capital decisioning capability to develop analyses like this:

This kind of analysis can be done at several levels in your company:

- Single Decision Level – For high-impact change initiatives or operational improvements, make sure the business case for your solution considers how the change will impact each capital and the net impact on sustainable corporate value.

- Team Management Level – For day-to-day management, make sure that teams can see and understand how their work impacts each applicable capital. Is the work creating, preserving, eroding, or destroying value?

- Corporate Level – For a full view, you’ll ultimately want to consider the multi-capital performance of the entire company. This can be done as a stand-alone analysis or by consolidating the results of all your value creation teams.

We find that this kind of qualitative analysis is very valuable way to start thinking about the sustainability of your business. It helps arm teams across your company with the structure and vocabulary to develop a systems view of your company’s value creation today and tomorrow. We hope it helps you make better decisions today to ensure sustainable corporate value into the future.

These screenshots are from the Insights7 Platform. Our free accounts enable organizations to manage up to three value creation teams, including the multi-capital analyses shown here. Sign up for a free Insights7 account and develop your own analysis now!